Table of Contents

- Progress on the Inflation Front, and Can We Avert Stagflation ...

- 23 Million California Residents to Receive up to ,050 in Inflation ...

- Californians are turning to increased credit card use to cope with ...

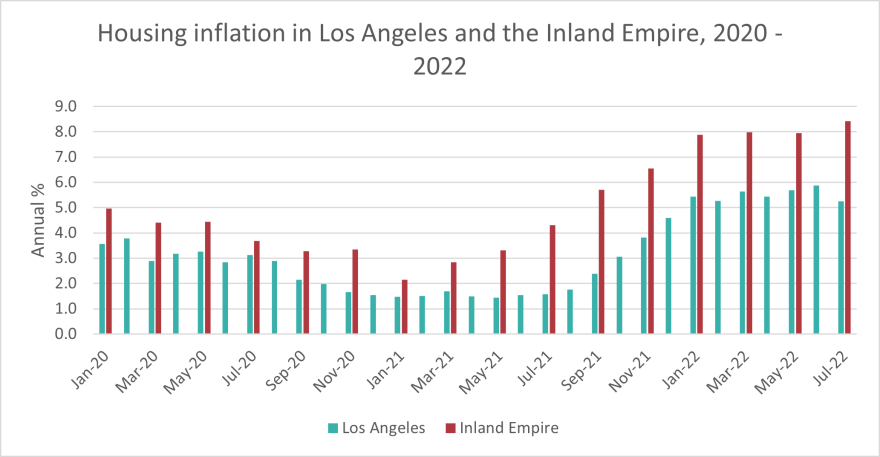

- Inland Empire experiencing higher inflation rate than Los Angeles and ...

- Cali. residents to receive up to ,050 in 'inflation relief'

- La California ritarda la piena applicazione delle norme sulla ...

- This region of California faces unsustainable levels of inflation - Archyde

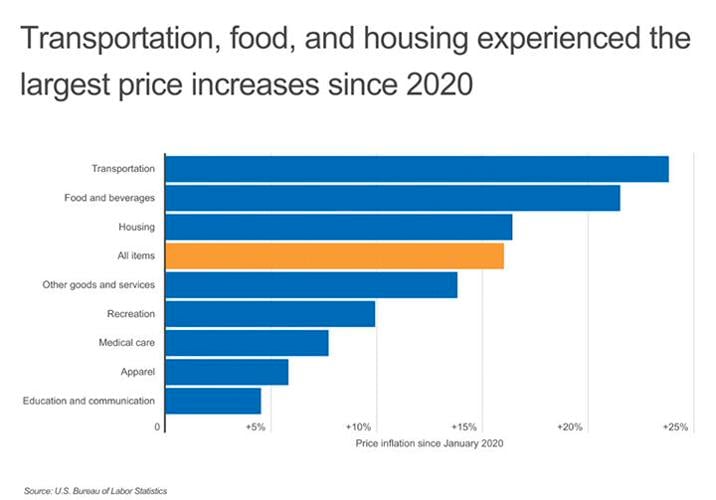

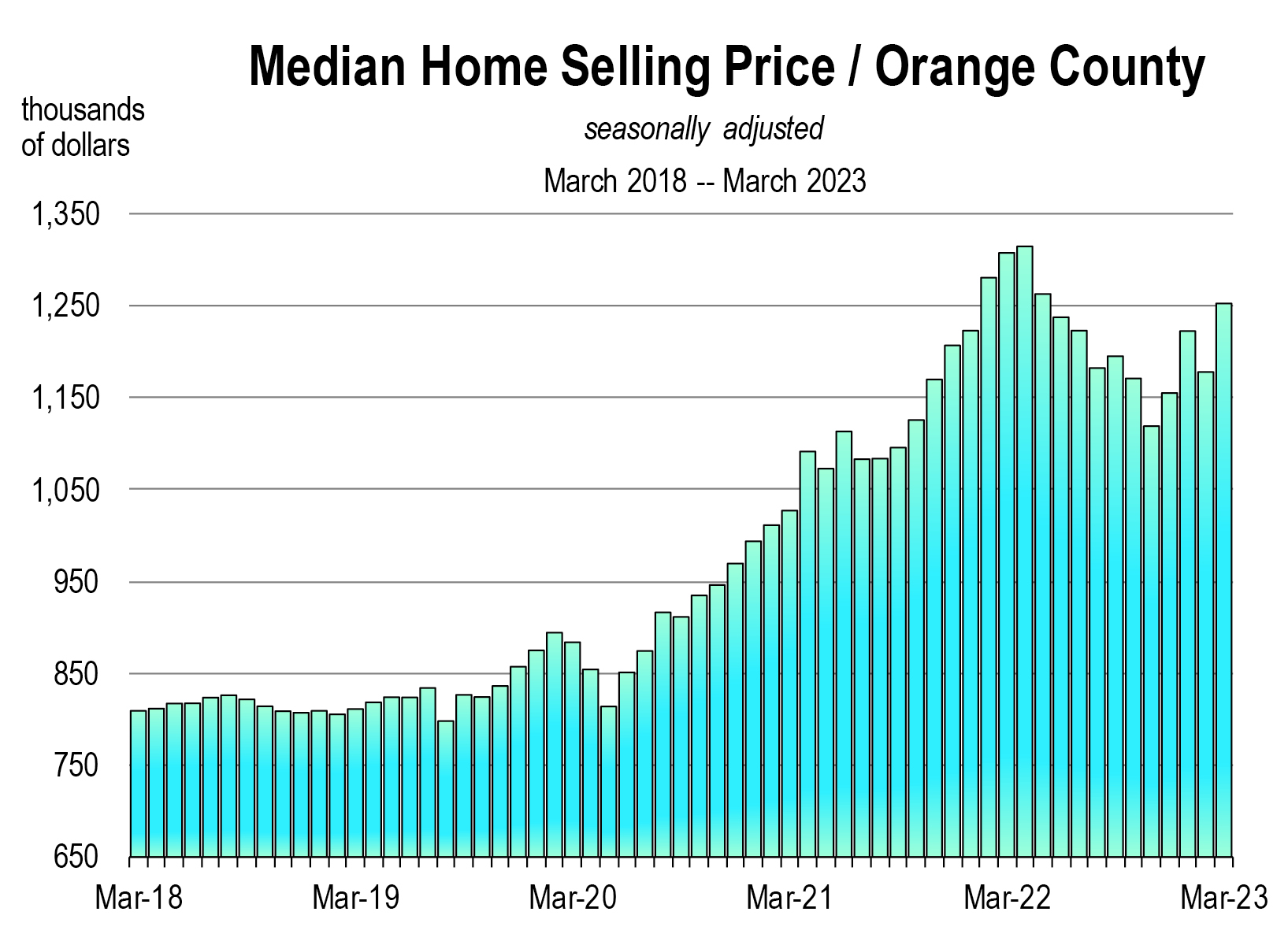

- Southern California inflation heats up in early 2024 – Orange County ...

- Making Sense of California’s Economy - Public Policy Institute of ...

- California Legislative Analyst | The Epoch Times

Historical Inflation Rates: 2000-2020

The following table highlights the annual inflation rates in the US from 2000 to 2020:

| Year | Inflation Rate |

|---|---|

| 2000 | 3.4% |

| 2001 | 2.8% |

| 2002 | 1.6% |

| 2003 | 2.3% |

| 2004 | 3.3% |

| 2005 | 3.4% |

| 2006 | 3.2% |

| 2007 | 2.9% |

| 2008 | 3.8% |

| 2009 | -0.4% |

| 2010 | 1.6% |

| 2011 | 3.0% |

| 2012 | 2.1% |

| 2013 | 1.5% |

| 2014 | 0.8% |

| 2015 | 0.1% |

| 2016 | 2.1% |

| 2017 | 2.1% |

| 2018 | 2.4% |

| 2019 | 2.3% |

| 2020 | 1.2% |

Projected Inflation Rates: 2021-2025

Using a US inflation calculator can help individuals and businesses make informed decisions about investments, savings, and pricing. By understanding the current and projected inflation rates, you can better navigate the economy and make smart financial choices.

In conclusion, understanding the current US inflation rates from 2000 to 2025 is crucial for making informed financial decisions. By analyzing historical data and projected trends, individuals and businesses can better navigate the economy and make smart choices about investments, savings, and pricing. Whether you're a consumer, investor, or business owner, using a US inflation calculator can help you stay ahead of the curve and achieve your financial goals.Stay up-to-date with the latest inflation trends and forecasts, and use the valuable insights and tools provided in this article to make informed decisions about your financial future.